The Most Important Info About Accounts Payable Process

Accounts Payable Cycle Example. Let's create a more complex, illustrative example for a hypothetical company that must balance multiple accounts payable concerns, taking into account incentives for early payments, penalties for late payments, and weekly cash flow considerations.

What is the Accounts Payable Process? Definition & Guide (2022)

Accounts payable refers to the money your business owes to its vendors for providing goods or services to you on credit. Typically, these are the short-term debt that you owe to your suppliers. In other words, the total amount outstanding that you owe to your suppliers or vendors comes under accounts payable.

Simplifying The Accounts Payable Process PLANERGY Software

Accounts payables turnover is a key metric used in calculating the liquidity of a company, as well as in analyzing and planning its cash cycle. A related metric is AP days (accounts payable days). This is the number of days it takes a company, on average, to pay off their AP balance. The cash cycle (or cash conversion cycle) is the amount of.

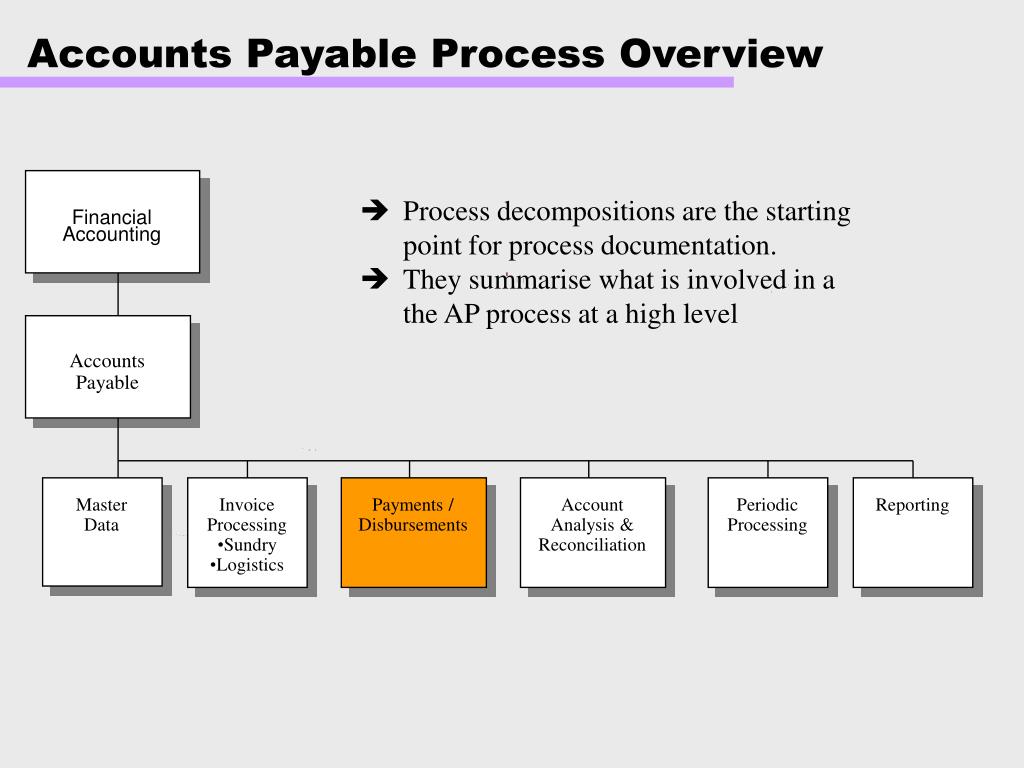

What Makes The Full Cycle Accounts Payable Process?

Accounts payable is a broad term that can apply not only to transactions with external vendors but internal accounting matters such as expense account charges and more. To keep things simple, we'll focus exclusively on vendor transactions in this guide. However, many of the same principles apply to petty cash expenses.

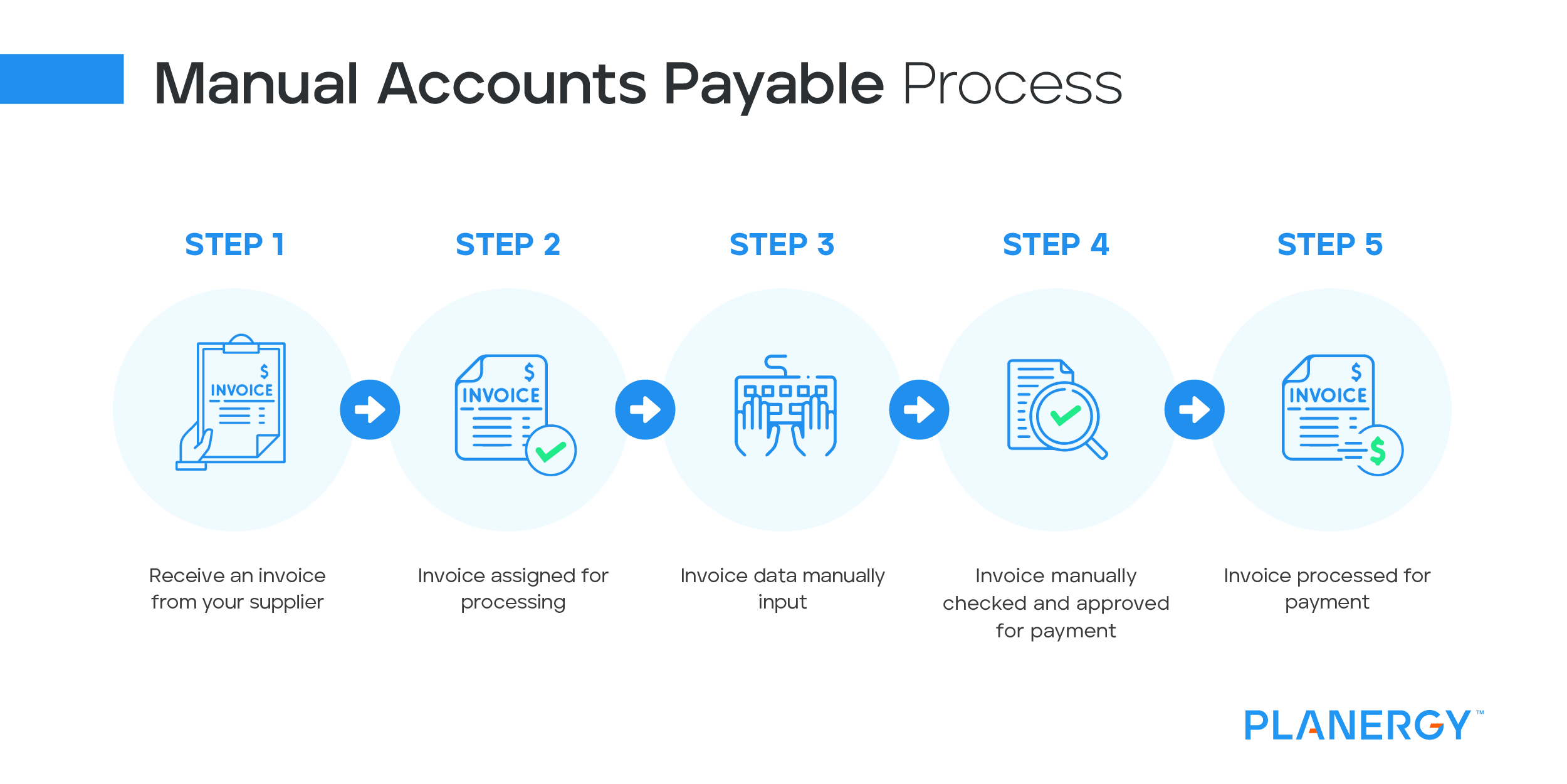

How To Process Accounts Payable Invoices

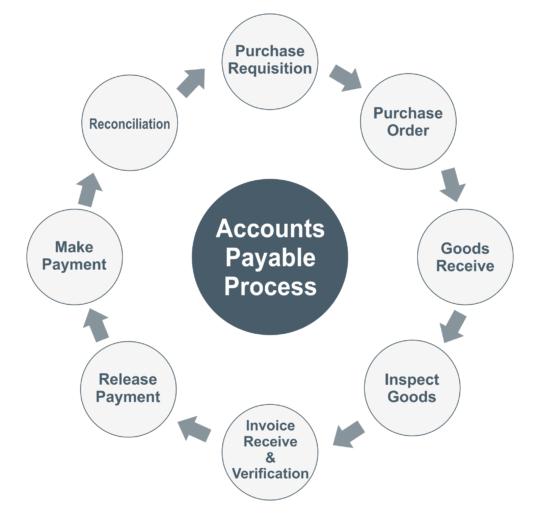

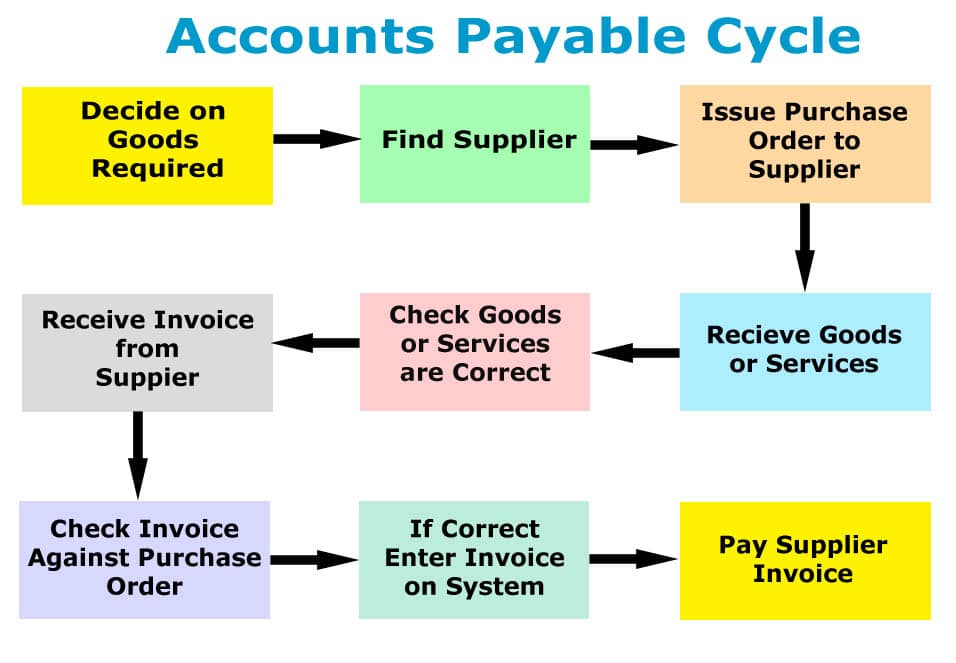

The full-cycle accounts payable cycle runs through several steps - from when you first get quotes right through to approving and executing payments. Why it matters Paying bills on time keeps suppliers sweet - and happy suppliers often reward customers with on-time-payment discounts or longer payment terms.

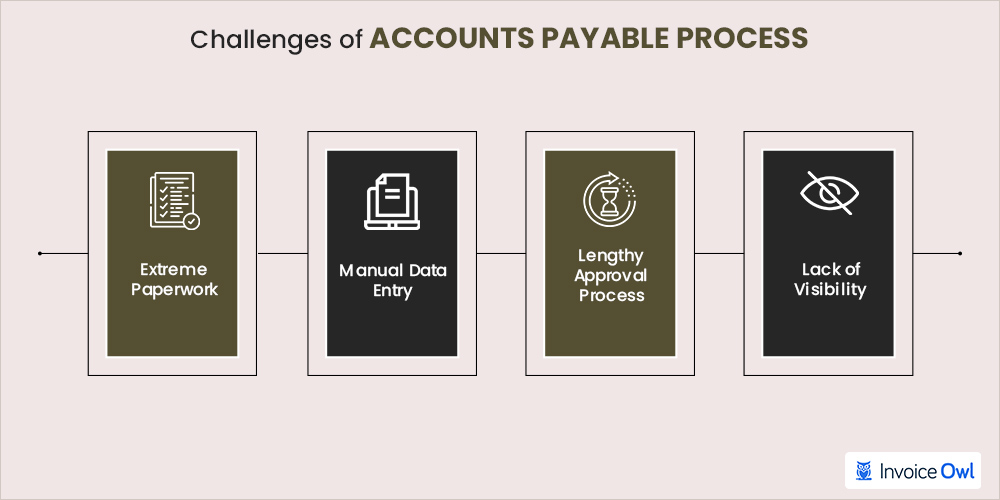

What Is A Settlement Run Accounts Payable

The accounts payable cycle entails several important steps that affect the business's bottom line directly. All accounting transactions need to be tracked closely for audit purposes. The accounts payable process must be streamlined with the right accounts payable software like Cflow. This is an all-in-one workflow software that automates the.

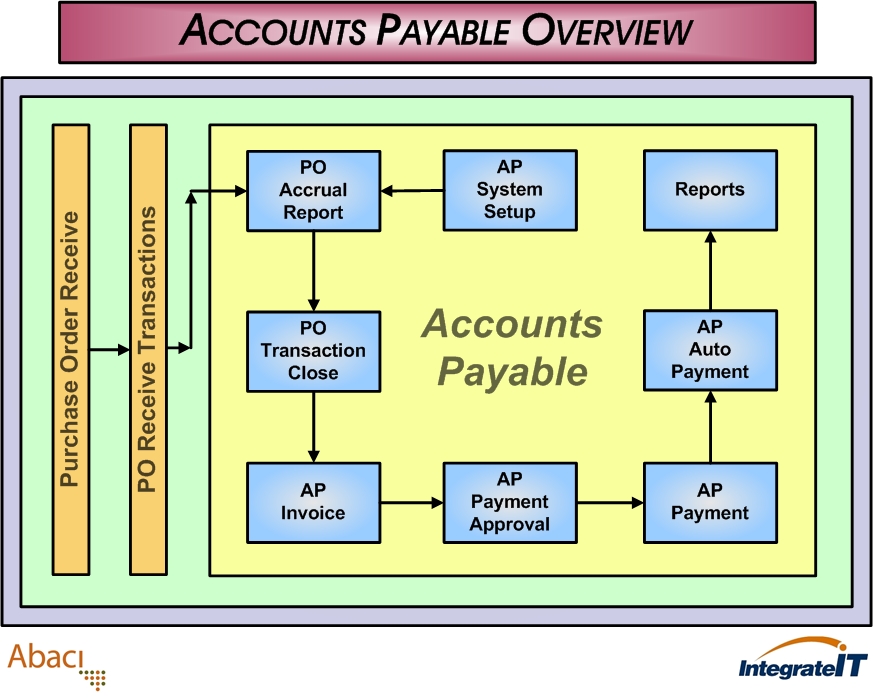

accountspayableoverview ERP123 A Better Approach to ERP

Accounts payable (AP), or "payables," refer to a company's short-term obligations owed to its creditors or suppliers, which have not yet been paid. Payables appear on a company's balance sheet as.

What Is Accounts Payable Cycle? Innovature BPO

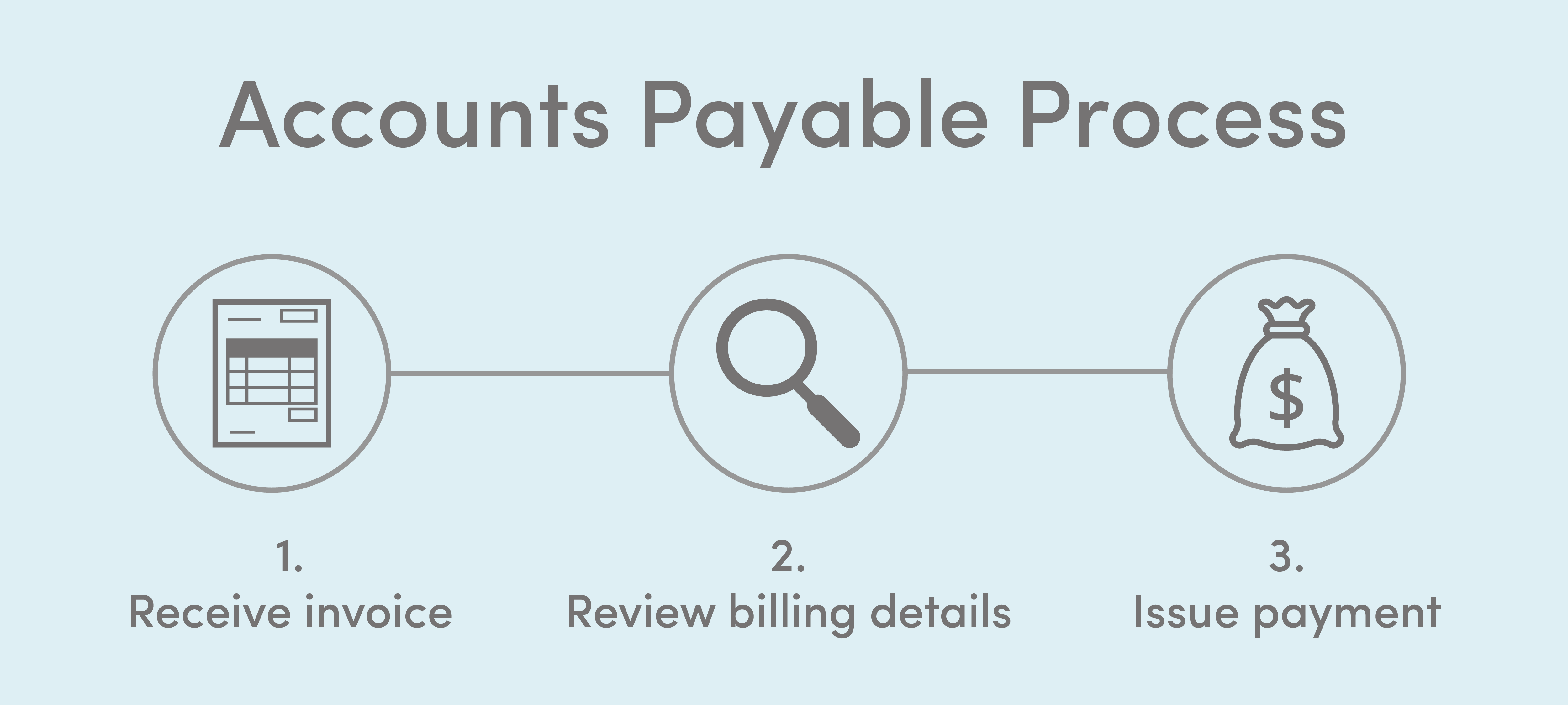

The accounts payable process is responsible for paying vendors for goods and services purchased by a company. While the complexity of the length of this cycle may differ from one company to the next, the following necessary steps are generally present in some form.

Accounts Payable Ledger 9 Steps Accounts Payable Cycle

Accounts payable process: Explaining the full cycle. Accounts payable is a core function of your accounting workflow. When considering how to manage these functions, internal controls and other safeguards can be important in preventing fraud. Streamlined and updated AP processes are crucial to keeping an accurate balance sheet and making timely.

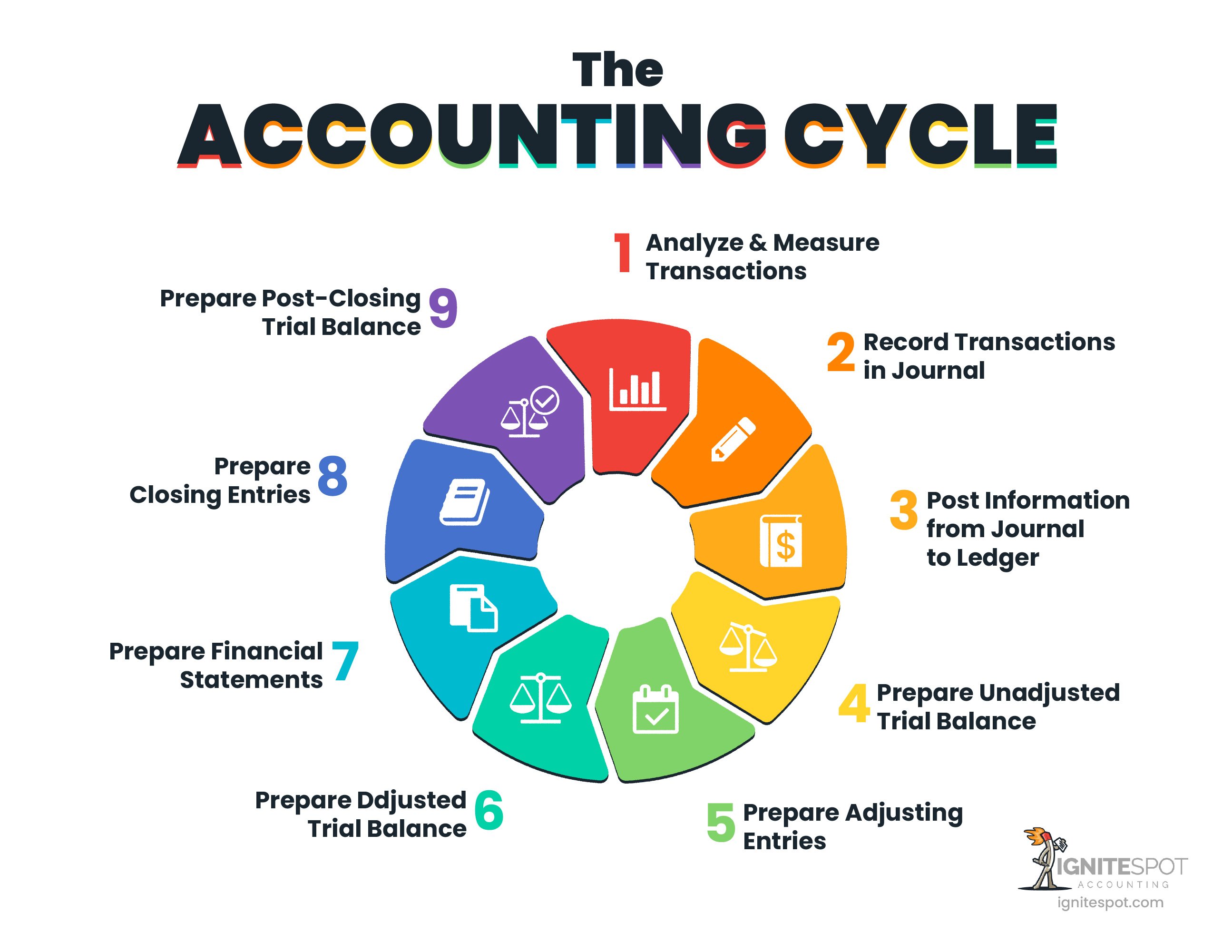

Basic Accounting The Accounting Cycle Explained

Accounts payable (often abbreviated as "AP") is a general ledger account that captures short-term payments owed to creditors, suppliers and vendors. Accounts payable are considered a current.

Accounts Payable Process and Cycle financepal

1. Purchase Order. The first step in the accounts payable process is sending out a purchase order (PO). For any service or goods that you order, you should send a PO to the supplying vendor to kick off the purchasing process. In some cases, the PO might be a physical document, and in others, the PO might be digital.

A Guide to Full Cycle Accounts Payable Process Tipalti

What is the Full Cycle of Accounts Payable? The full cycle of accounts payable is an accounting process in which businesses manage and track payments made to suppliers for goods and services from the ordering process up until the payment.

Improve Your Accounts Payable Process with Flowcharts (Examples Included)

Full cycle accounts payable begins in each department when procurement has gone through the steps to procure a good or service from a vendor and accounts payable has received an invoice. Accounts payable then verifies the invoice is valid and goods have been delivered, then pays the invoice. Full cycle accounts payable is also an umbrella term.

Accounts Payable Process 2022 Guide frevvo Blog

The accounts payable (AP) process involves the management and execution of the company's short-term payment obligations to vendors/suppliers. Having a streamlined accounts payable workflow improves the transparency and accuracy of buyer-supplier transactions. The accounts payable process is an important part of the procure-to-pay process.

Accounts Receivable vs Accounts Payable Impact on Cash Flow

Full cycle accounts payable, as the name implies, is the complete cycle that an accounts payable department goes through to complete and archive a purchase. From receiving and approving invoices to paying vendors and suppliers for their goods and services, the AP process is critical to any business.

Accounts Payable Process Shenandoah, TX

Accounts payable refers to the amount of money a business owes to its suppliers and vendors for goods or services received. This can include things like inventory, raw materials, utilities, rent, and other business related expenses. Accounts payable is a liability on your balance sheet because it represents debt you owe to others.